2024: Top Three Picks

The gig economy is coming of age!

Last year, all of my picks were in the technology sector Last_year. This time around, I have included a pharma company. My three picks are as follows:

Gilead Sciences

Airbnb

Uber

Gilead Sciences and Airbnb are new positions for me; therefore, I will concentrate on the raison d'etre of these picks. Before delving into each company, I would like to say a few words about my investment philosophy and offer a short top-down perspective on the stock market for 2024. This preliminary discussion is intended to illustrate how my picks fit in with a view of the bigger picture.

Investment philosophy

My investment approach revolves around identifying high-quality companies capable of compounding the value of my investments. My new investments shall operate in large total addressable markets. where the demand for their products is largely untapped, so the runway for growth is large. Furthermore, these companies need to have strong management that puts the interests of their shareholders first and allocates capital accordingly. Finally, I adhere to a valuation strategy that avoids investing in companies deemed overvalued according to my valuation methods, putting a “margin of safety” (Graham and Dodd, 1934) stamp on my investments.

Typically, I choose to invest in companies that I perceive as compounders of capital, allocating funds to these until they constitute a minimum of 5% of my overall portfolio. Subsequently, I adopt a passive approach, allowing these investments to compound without further intervention.

Market view

I acknowledge that many market pundits don’t accept that we are in the second year of a new bull market. This is nothing new, after the great financial recession it took nearly 4 years before everyone accepted that stocks were not in the death throes of a depression. So, Bull markets are never born in euphoria.

Drawing from my experience, I anticipate substantial volatility in the upcoming year. The trajectory of events appears contingent on the Federal Reserve's decision to initiate interest rate cuts. The most bearish market participants say that the rate cut cycle will start in March, while the most bullish push the start date out to the autumn. My view is that the negative money supply, going on for 2 years now, entails that the Federal Reserve will start sooner rather than later. Still, I am aware that this is impossible to predict accurately.

In my assessment, I believe that all my picks will be higher one year from now, but I admonish that Airbnb and Uber have the composure to swing more in accordance with shifting market sentiment than Gilead Sciences. By throwing Gilead into the mix, I hope to reduce volatility somewhat.

Gilead Sciences

Gilead is the company that infamously provided the cure for Hepatitis C, a deadly disease that inflicts around 300,000 each year. The only problem with providing a cure is that patients don’t return after the therapies end and that every medicine goes off patent sooner or later. In 2015, Gilead's annual revenue stood at around $32 billion, now reduced to $27 billion. However, the strategic allocation of funds from its Hepatitis wonder drug revenues towards R&D and the acquisition of numerous smaller biotech firms has transformed Gilead into a diversified pharmaceutical entity addressing a spectrum of health issues, from viruses to inflammation and cancer.

Gilead’s HIV therapies represent the bulk of revenues today, and the company has 50 % of the market share for HIV treatment and preppers in the US. Biktarvy is the blockbuster drug in this category and doesn’t go off patent before 2033. GSK is the main competitor globally in the HIV space. It is hard to judge exactly, but it looks to me that Gilead’s pipeline is strong enough to ensure that the company will hold its position going forward in this area.

Hepatitis, or liver disease as Gilead calls it in its presentations, is a considerably lesser part of the business than it once was, and nowadays it doesn’t have much larger shares of revenues than the oncology division. It is Gilead’s oncology treatments that are the reason why I mean you should buy stocks in this company. Gilead’s cancer medicines are growing 30 % YoY, and its oncology therapies against breast, blood, and lung cancers are very successful.

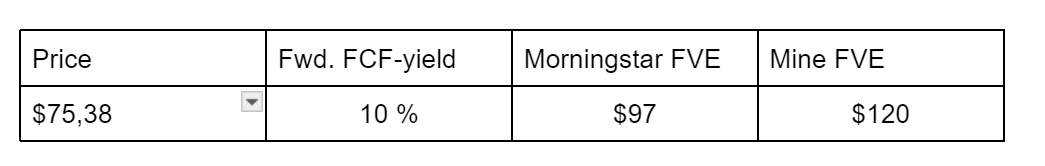

With a goal to have cancer therapies contributing to one-third of total revenues by 2030, and considering the promising pipeline, Gilead appears poised for success. While consensus estimates anticipate modest revenue growth, not surpassing the $32B mark, I am more optimistic, projecting revenues between $35 - $40 billion by 2033. Gilead's dividend yield of 4%, coupled with a buyback yield of 1.5%, results in a total yield of 5.5%. Taking the company's historical operating profits into account, Gilead seems inclined to maintain an EBIT margin above 40%. Furthermore, its free cash flow yield of 10% indicates undervalued shares. Consequently, my estimates surpass Morningstar's, reflecting confidence in Gilead's future growth and financial stability.

Airbnb

Sometimes a business is so profitable that it is hard to figure out what is going on. That Airbnb is converting 40 % of its revenue stream into free cash flow is something that baffles the mind. I have only seen similar numbers in two other companies, Visa and Mastercard, and we all know how favorable an investment in these two companies has been.

Listening intermittently to Airbnb's CEO and founder, Brian Chesky, one gets some glimpses into why the company is so profitable, Chesky explains that during the pandemic, he made a strategic choice to focus on core services. On the Airbnb application, you get short-term rental listings and nothing more. you don’t get flight offers, car rental deals, or anything else that for example Booking Holdings and Expedia offer. This deliberate narrowing down to core services allows Airbnb to optimize the user experience, resulting in substantial fees being paid to the platform owner.

In the last quarterly report, Airbnb grew its gross bookings by 14 % YoY. While the company is heavily centered on America, Brian Chesky aims for faster global growth, implementing a global expansion playbook to guide the company toward a worldwide footprint. Airbnb is growing very fast in Germany and South Korea at the moment. Chesky often points out that 9 out of every 10 nights are spent in hotels by travelers. Consequently, Airbnb wants to grow its market share, and Chesky says that revenues will grow by over 10 % for many years to come, due to the fact that many markets are unpenetrated.

As a traveler myself, I personally prefer using Booking Holdings and hotels for shorter stays, reserving Airbnb for longer durations. Statistics from Airbnb indicate that 20% of stays on its platform extend to three months or more, suggesting a clientele of freelancers, digital nomads, and remote workers. Airbnb strategically utilizes its generated cash to reinvest in enhancing the host experience. Airbnb’s engineers are continuously working to give the hosts marketing and independent pricing tools. The platform currently experiences more growth on the supply than the demand side, with the number of hosts increasing by 19% YoY in the last quarterly report, ensuring a balanced marketplace. Airbnb has around 4 million hosts.

I am in agreement with Morningstar on the fair value assessment. Take note, however, that Airbnb's valuation is highly sensitive to financial conditions and the company's free cash flow generation. The quarterly increase in Airbnb's enterprise value is substantial due to the accumulation of cash on its balance sheet. Take also note of the fact that Airbnb’s count of outstanding shares is slowly increasing despite its buyback yield of 2,5 %. This happens because Airbnb gives its employees stock-based compensation. Still, I anticipate that buybacks will offset this compensation by 2025. In conclusion, I think you should hand your money over to Brian Chesky, it is better that this genius grows your wealth, rather than you trying to do smart things on your own.

In my view, an immediate challenge for Airbnb is to attract more travelers from the retired boomer generation. These retirees have, in many instances, good personal finances, and have nothing more to use their money on than leisure. I can imagine that this group, however, is more inclined to stay at hotels rather than Airbnb. It is up to Brian Chesky and his team to make the Boomers more comfortable with their innovative services. Then growth can really accelerate.

Uber

They say that one of the greatest sins in the stock market is to fall in love with one's investments. Uber has gone up more than 100 % this year, so why don’t I take a profit? Well, in my reasoning, Uber is still really cheap. In fact, I see already now that I have underestimated the profit margins that Uber is printing, so I have to adjust my fair value estimate upwards.

Looking ahead to the coming year, numerous catalysts are poised to come into play. Firstly, Uber's inclusion in several crucial indexes is anticipated, triggering interest from indexers across the market. Additionally, the signal from Uber's CEO regarding the initiation of stock buybacks adds another dimension. I am also optimistic about Uber's continued ascent leading up to the year-end. The prevailing sentiment on Wall Street indicates an awareness that the combination of undervaluation and an automatic market bid is likely to propel the stock price higher. Personally, I think this company is going to be a ten-bagger, so I am adding when I can, and sticking with it. You haven’t seen anything yet. Great investors have patience.

Stocks that nearly made it

Gilead is not the only company that grows fast within oncology. I think, for instance, that Genmab is going to grow just as fast GMABQ3. My selection of Gilead fell down to Genmab's lack of dividends and higher price volatility. It is also hard to avoid mentioning the oncology behemoth AstraZeneca, but this company is not exactly undervalued. Eli Lilly’s phase 3 trials of an Alzheimer's therapy that looks to have high efficacy is also an interesting case. The question is, however, how to ascertain whether the promising results already are reflected in the share price.

I also considered taking a flyer on artificial intelligence (AI). Arista Networks is a company I believe in for the upcoming year Networks. However, the stock shot immediately to the upside after the 3rd quarterly report, and the share price didn’t exactly slow down by being included in Tom Lee’s Granny Shots. I have, however, taken a small position in Pure Storage Storage. I foresee Pure's Flashblades gaining traction in the AI landscape, and the stock remains under the radar of global Wall Street.

Another company that nearly made it was Cognizant Technology. Cognizant’s book-to-bill ratio indicates that the profitability will increase substantially next year. Ultimately, my choice leaned towards Gilead, aiming to maintain a balanced portfolio and avoid excessive concentration in the technology sector.

For Norwegians with a home bias

I have many Norwegian readers. Some are also having a strong home bias. I see that a few of them don’t read stuff about foreign companies. Within the Norwegian market, I perceive the tech sector to be notably undervalued. Additionally, companies in this sector are drawing interest as potential takeover targets for various foreign private equity groups. Leveraging the significant underpricing, I have augmented my position in Itera ITEQ3. Nevertheless, I believe there also is potential for favorable outcomes by investing in Atea, Norbit, Bouvet, or Crayon. It wouldn't surprise me if those who assemble a diverse portfolio of Norwegian tech companies outperform my selection in 2024. However, I harbor reservations about whether many Norwegian companies possess the same enduring compounding qualities.

Must the odds forever be in our favor!

Disclaimer: Important Information for Retail Investors

The information provided in this blog is intended for educational and informational purposes only and should not be construed as financial advice or a recommendation to buy, sell, or hold any securities. Investing in individual stocks involves inherent risks, and past performance is not indicative of future results. Before making any investment decisions, it is crucial to conduct thorough research and consider seeking advice from qualified financial professionals.

The author of this blog is a retail investor and not a licensed financial advisor or registered investment professional. While the author strives to present accurate and up-to-date information, there is no guarantee that the content provided is accurate, complete, or current. Market conditions can change rapidly, and stock prices can be volatile.

All investments carry a degree of risk, including the potential loss of principal. Retail investors should carefully assess their risk tolerance and investment goals before making any investment decisions. Diversification is a key strategy to manage risk, and investing solely in individual stocks may expose investors to higher levels of risk compared to a diversified portfolio.

The author may have positions in the stocks mentioned in the blog. These positions may change at any time, and the author is under no obligation to update readers on such changes. It is recommended that readers do their own due diligence and consider seeking advice from qualified professionals before acting on any information presented in this blog.

Investors should be aware of the inherent limitations of the information available on the internet, including the potential for misinformation and bias. Always verify information from credible sources and cross-reference any data presented in this blog.

In accordance with prudent compliance, the author encourages readers to carefully review and understand the prospectuses, annual reports, financial statements, and other relevant information before making investment decisions. Retail investors should be aware of their own financial situation and consult with appropriate professionals to ensure that their investment choices align with their individual circumstances and goals.

By accessing and using this blog, readers acknowledge and agree that they are responsible for their own investment decisions and any outcomes that may result.