Uber Technologies

A winner on sale!

It’s rare for a business that accelerates across all growth metrics to be punished by the market. Yet, UBER is down over 8% this year. This is despite compounding at 22% gross bookings growth, delivering 15 billion trips annually, and serving 202 million monthly active users.

So, what is going on here? In short, market participants are worried that autonomous vehicle (AV) operators will disrupt UBER’s business model and erode its ability to generate free cash flow over the long haul.

I am not worried about this scenario at all, and let me tell you why in a few bulletpoints.

Time

Investors often underestimate how long transitions take. In the early days of the pandemic, investors piled into green technology companies, betting big on the end of hydrocarbons. 5 years later, oil and gas still rule the roost in the energy sector, and many green technology companies collapsed in the stock market. Investors who telescoped the future got burned.

We got the same now in the transport sector. No doubt, the robots are coming, but we will have human drivers for a long time. Serious analysts see full autonomy as a multi‑decade transition, not a sudden flip. Urban robotaxi services in geofenced areas will expand through the 2020s. Full self-driving (FSD) in all conditions is far harder: regulation, liability, edge‑case safety, and infrastructure all move slowly. Even once the technology is mature, the installed base of human‑driven cars will take 10–20 years to turn over, just as with previous drivetrain shifts. Realistically, you’re probably looking at well past 2040, and in many regions after 2050, before humans are totally out of the picture.

Geographical realities

UBER runs on both bits and atoms. Bits are easily replaceable. New code can simply be copied, piped through fiber, and downloaded by users. Atoms are more cumbersome to scale. Cars have to be produced one by one.

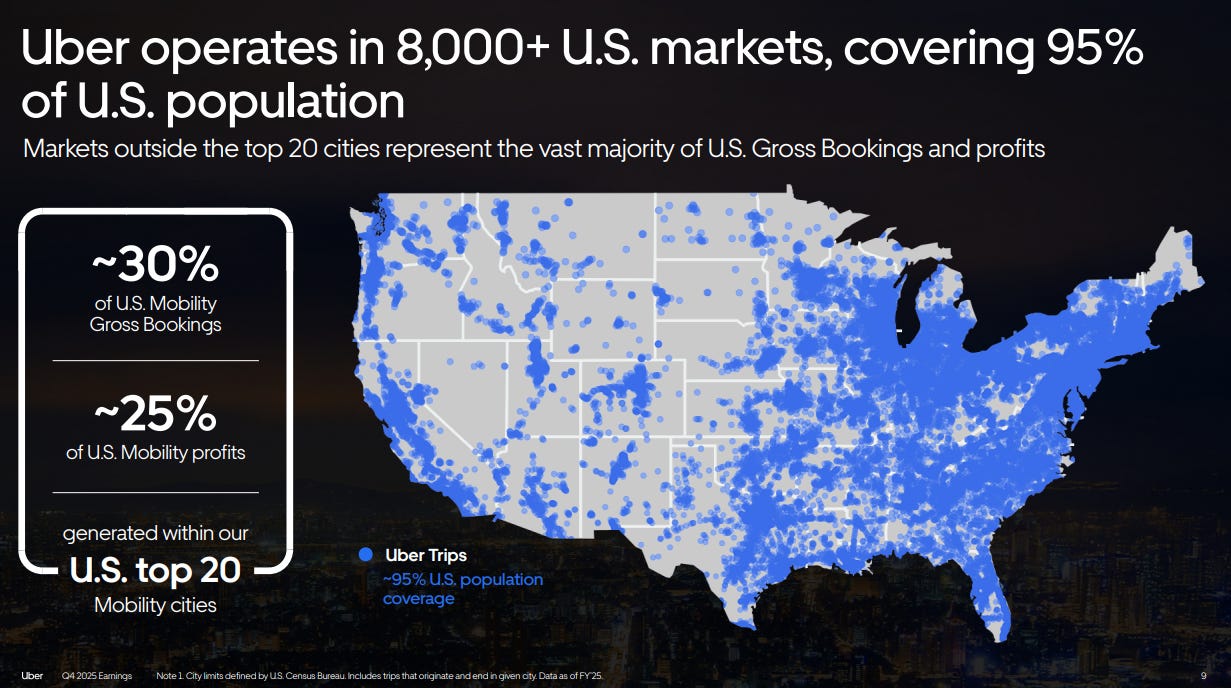

Robotaxi launches in big cities sounds impressive, but most people live in suburbs or smaller towns. The top 20 U.S. metro areas generate just 25% of Uber’s domestic revenue. AVs thus touch only a sliver of the business today (see figure below). In a similar vein, we must remember that 60% of UBER’s revenue comes from outside the US.

Demand realities

Jevons’ paradox states that technological improvements in resource efficiency often lead to increased overall consumption of that resource.

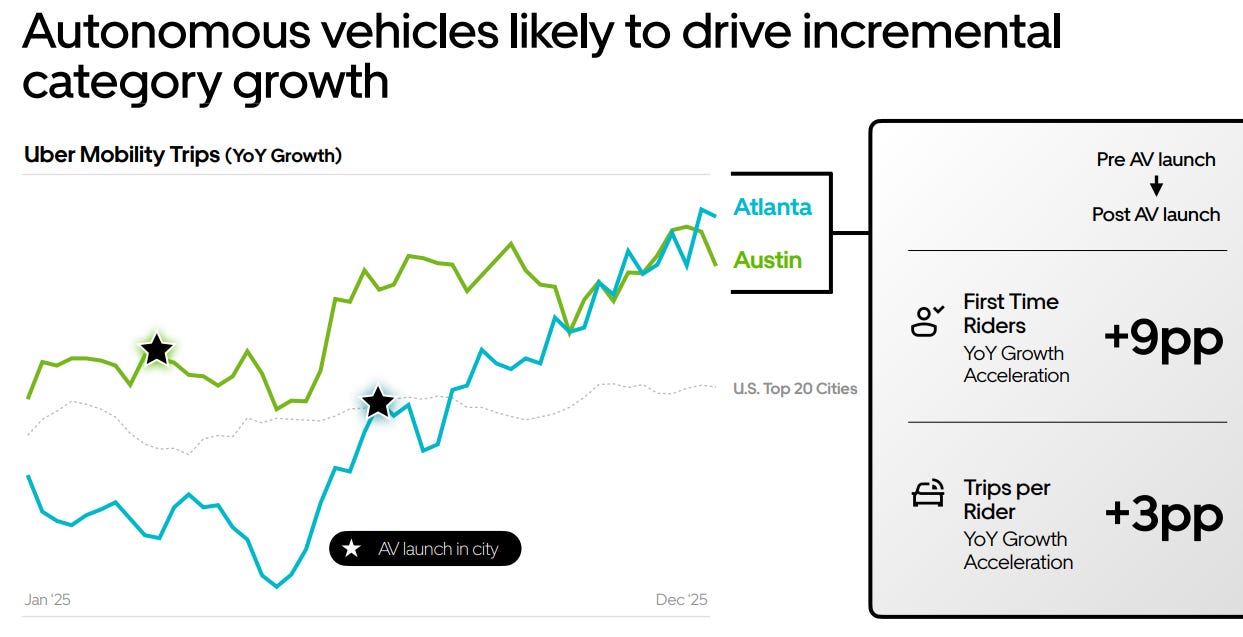

What UBER sees is that overall demand increases wherever robotaxis enters the market. In fact, UBER grows faster in markets with competition from robotaxis than without them (see figure below). Furthermore, in some cities, Waymo is an option on the UBER app.

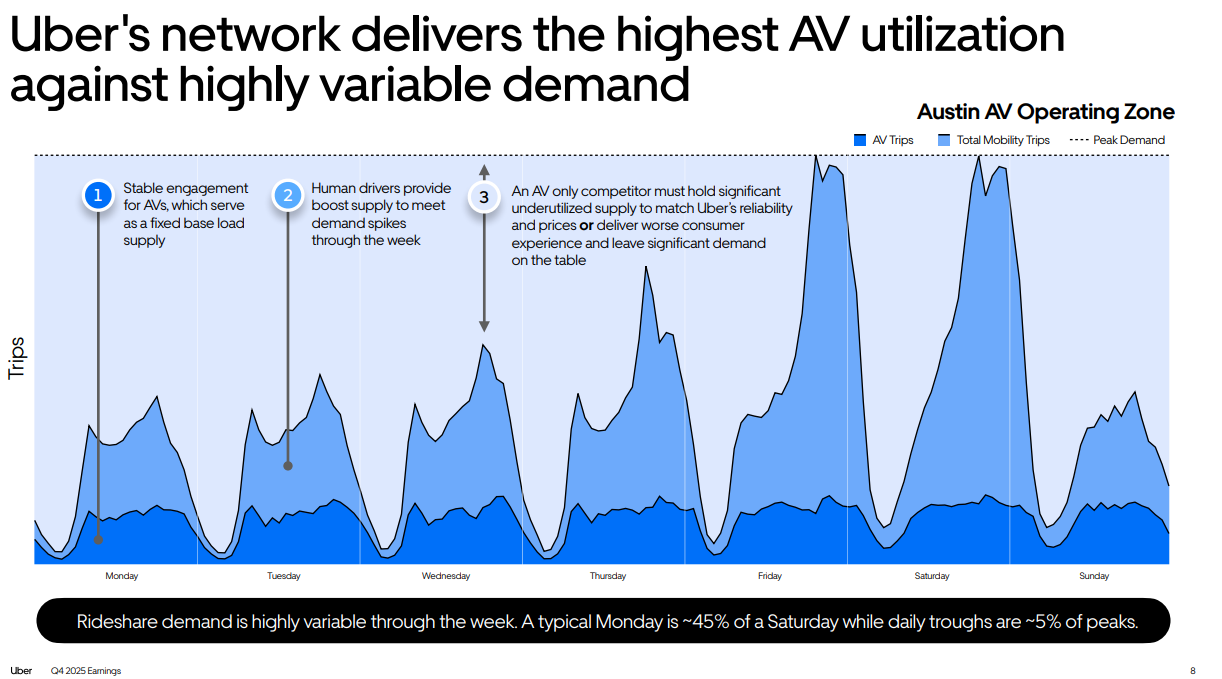

There is another feature to note about Waymo’s and Tesla’s AV fleets. They are expensive to operate and have a relatively fixed scale. At demand peaks, there are not enough of them to serve the whole market. UBER is more flexible at scale, and in rush hours, it can use incentive pricing to get drivers out in the streets (see figure below). As long as an oversupply of robotaxis doesn’t exist, Uber stands to thrive even though it doesn’t have access to robotaxis on its own platform. It’s the textbook Jevons.

We can introduce another paradox. At the current moment, the only business that will reap profitable rewards from the introduction of robotaxis is UBER, and it will hold for a very long time. A standalone Waymo or Tesla app can’t replace UBER in the next decade, the cash burn will simply be too huge.

Not everything is ridesharing

The market might overlook that UBER isn’t all about mobility. Delivery is the category that grows fastest (36%). CEO Dara Khosrowshahi highlighted the role of two-wheelers in this segment during the earnings call, and motorcycles won’t go autonomous anytime soon.

Autonomy’s delivery impact will likely come via drones for groceries and food, where Uber is already piloting with startups.

Freight rounds out the platform. Uber’s long-haul footprint remains small, but partnerships with autonomous trucking pioneers position it well. Scaling freight meaningfully, however, demands heavier investment ahead

Blackboxing

“Blackboxing is the way scientific and technical work is made invisible by its own success. When a machine runs efficiently, when a matter of fact is settled, we forget about all the forces inscribed in it.”

AV’s will inevitably get blackboxed: users summon a ride, a vehicle arrives, and internals are hidden. Like summoning an Uber today, riders won’t care whether it’s Waymo, Tesla, or another fleet provider; the app owns the interface, and customer preferences will decide the outcome, premium or regular, big or small. In the end, self-driving technology will be ubiquitous. Every car brand will have it, and it is you, as a consumer, who decides whether you will have a premium ride or a toaster oven without windows.

Alas, it is fleet management, not technology, that will decide who wins in the AV ridesharing space. And I assume UBER is the ultimate winner in such a landscape. UBER is already collaborating with the leading fleet managers, and as self-driving tech commoditizes, fleet operators will chase slots on Uber’s app, paying for access to its demand flywheel. Flexible pricing, cross-selling (rides + delivery), and data-driven matching remain Uber’s locked-in advantages in the AV transformation.

The market’s discount ignores this trajectory. At 15x forward FCF, UBER trades like a loser, not a compounding platform printing $10 billion annually. In the end, markets are a weighting machine, not a voting machine. Winners can’t stay this cheap forever.

Disclaimer: Important Information for Retail Investors

The information in this blog is for educational purposes only, not financial advice. Investing in stocks carries risks; past performance doesn’t guarantee future results. Conduct thorough research and seek advice from financial professionals before investing.

The author is a retail investor, not a licensed advisor. Due to changing market conditions, content accuracy isn’t guaranteed. All investments have risks, including the potential loss of principal. Assess your risk tolerance and goals before investing; diversification is key to managing risk.

The author may have positions in the mentioned stocks, which can change without notice. Readers should do their due diligence and consult professionals before acting on blog information.

Before investing, verify information from credible sources, understand prospectuses and financial statements, be aware of your financial situation, and consult professionals for aligned investment choices.

Readers are responsible for their investment decisions; the author is not liable for any outcomes. Investing in individual stocks carries risks; therefore, exercising caution, conducting thorough research, and seeking professional guidance are recommended for informed investment decisions.