Merck’s share price has risen by over 17% this year. Let’s look into whether we can expect the positive momentum to continue from here.

There are three valuation drivers for a stock, Firstly, how does the growth look? Thus, what are the future revenues going to be? Secondly, How profitable is the company? Alas, what kind of operating profits is the company going to deliver? And lastly, what is the risk of failure? Hence, how certain are we that the company is going to deliver on our projected growth and profitability expectations?

For pharma companies, non-GAAP profit margins are in most cases remarkably stable. It usually fluctuates around 40%. Merck is no different. However, the risk is idiosyncratic for each company in this space, in most cases attached to when important medicines go off patent, and these risks govern much of the growth we can expect to see on the top line.

Last year

Merck only managed to grow its revenue by 1% in 2023. The weak result was mainly driven by reduced demand for Covid-19 treatments. If we exclude the pandemic gyrations from total sales, the underlying revenue growth is 9%. We can, therefore, expect growth to pick up again this year due to more favorable comparables.

The patent cliff in 2028

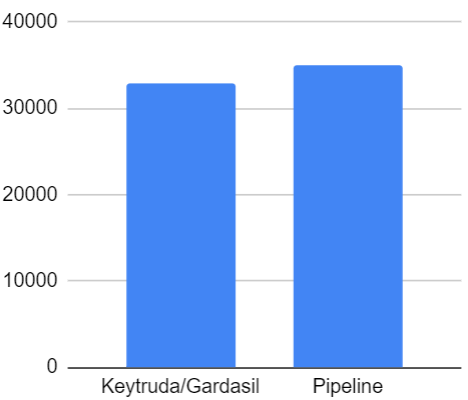

Merck is a successful company. The company sells medicines for over $60B treating approximately 500 million people each year. The problem is that over half of the sales are driven by two blockbuster medicines, as you can see from the table below, and that both of these therapies go off-patent in 2028. From this point on, we can, therefore, expect sales and profitability to take a hit, if Merck isn’t able to find something that can replace these two entities in its drug portfolio.

Pipeline strength

Merck has a solid pipeline with over 20 trials going on in phase III for the time being. The question is whether this pipeline is of such a substance that it can equalize the patent cliff in 2028. As you can see from the figure below, Merck is putting a >$35B sales value on its upcoming portfolio of drugs in the next decade.

Given that Merkc’s estimates hold, we see that it will prove to counterbalance most of the loss that will come from the competition of biosimilars to Keytruda and Gardasil in the next decade.

The difficulties of replacing Blockbuster's

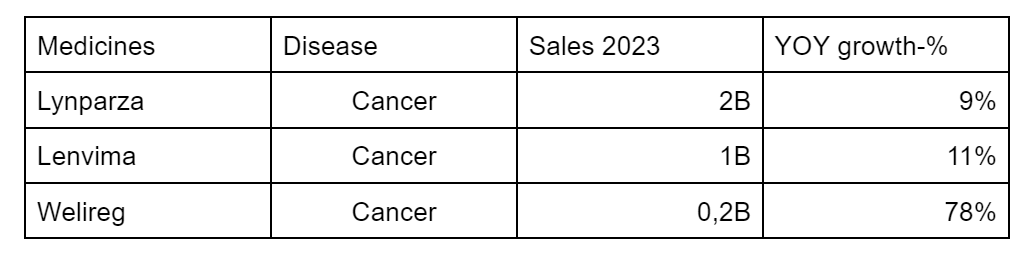

Replacing successful drugs is easier said than done, medicines like Keytruda don’t come along very often. We can see this from other oncology therapies Merck has in its portfolio. The drugs are good, but as you can see from the table below, they don’t sell nearly at the same level and rarely grow at the same rate.

Revenue projection

Based on this information, we should be able to give an approximate assessment of revenue growth from now on. Merck’s pipeline is strong but it is unlikely to be so strong that it will stop revenue growth to dampen in 2029 and 2030. Sales are not going to fall like a stone in these two years because customers are still likely to want both Keytruda and Gardasil, but Merck will not be able to charge the same prices as before. In any case, the downturn is likely to be short and at the beginning of the next decade, growth is likely to resume. My revenue projection is listed below:

Buy, sell, or hold

Merck is fairly valued in my DCF valuation. In the short term, the drug portfolio is going to drive Merck’s profitability higher, and the share price is, therefore, likely to appreciate in the next few years. The question is how much?

Longer term, there are risks in this stock, since the stock is fully valued, and since we slowly but surely are going into the patent cliff, the pricing of the stock is going to be increasingly priced based on its pipeline. Right now, investors look favorable at the strength of Merck’s pipeline, but this can change on a dime. If there are a few bad readouts from the numerous trials, investor sentiment can suddenly go south. Thus, I would be careful with Merck here.

As previously stated, Merck comprises around 4% of my portfolio. It has been a good investment, up 75% in around 4 years. I think I am going to trim this position and take some profits. Maybe, I sell ⅔ of my holding, or something like that. There is long-term value in this company, and the future looks bright, so I am not selling the whole position. I would seek to increase my position when the company becomes undervalued again. Merck is a company that you buy when others are fearful, and not greedy, as is the state today Oncology is in a secular growth market, so Merck is a company that needs to be continuously revisited.

…………………………

I am not sure how useful this was for my readers. If you don’t own Merck, I can understand that you don’t care. However, I hope there is something to be learned, getting a short glimpse into how I analyze a pharma company. You have to keep track of the three drivers of valuation: Growth, profits, and risks.

Disclaimer: Important Information for Retail Investors

The information provided in this blog is intended for educational and informational purposes only and should not be construed as financial advice or a recommendation to buy, sell, or hold any securities. Investing in individual stocks involves inherent risks, and past performance is not indicative of future results. Before making any investment decisions, it is crucial to conduct thorough research and consider seeking advice from qualified financial professionals.

The author of this blog is a retail investor and not a licensed financial advisor or registered investment professional. While the author strives to present accurate and up-to-date information, there is no guarantee that the content provided is accurate, complete, or current. Market conditions can change rapidly, and stock prices can be volatile.

All investments carry a degree of risk, including the potential loss of principal. Retail investors should carefully assess their risk tolerance and investment goals before making any investment decisions. Diversification is a key strategy to manage risk, and investing solely in individual stocks may expose investors to higher levels of risk compared to a diversified portfolio.

The author may have positions in the stocks mentioned in the blog. These positions may change at any time, and the author is under no obligation to update readers on such changes. It is recommended that readers do their own due diligence and consider seeking advice from qualified professionals before acting on any information presented in this blog.

Investors should be aware of the inherent limitations of the information available on the internet, including the potential for misinformation and bias. Always verify information from credible sources and cross-reference any data presented in this blog.

In accordance with prudent compliance, the author encourages readers to carefully review and understand the prospectuses, annual reports, financial statements, and other relevant information before making investment decisions. Retail investors should be aware of their own financial situation and consult with appropriate professionals to ensure that their investment choices align with their individual circumstances and goals.

By accessing and using this blog, readers acknowledge and agree that they are responsible for their own investment decisions and any outcomes that may result. The author and any related parties are not liable for any losses, damages, or actions arising from the use of the information provided in this blog.

In conclusion, investing in individual stocks carries risks that may not be suitable for all investors. Retail investors are advised to exercise caution, conduct thorough research, and consider seeking guidance from qualified financial professionals to make informed investment decisions.