Math Sunday

How overvalued is the market?

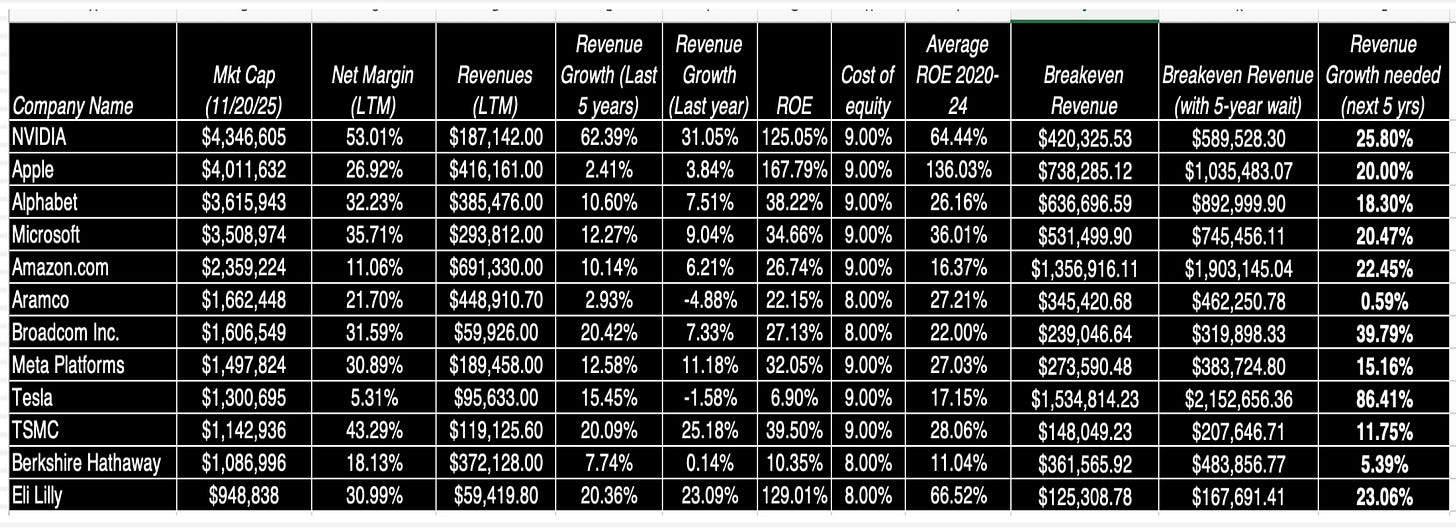

Are Meta, Apple, and the other companies with a trillion-dollar market capitalization overvalued? The professor of Finance at NYU, Aswath Domodoran, tried to answer this question in an interesting blog post yesterday. His question was: how much revenue must a company generate to justify its market capitalization? I found the valuation technique fairly novel, so let’s just dive into the methods and results.

Tesla must grow 88% annually

Let’s discuss the results first. The last three columns are the most interesting. These columns show how much revenue, time, and expansion the companies need to “grow into” their market cap.

The results give us perspectives. Tesla must grow its topline by 88% each year for the next five years, almost the same amount of sales as it does today. Broadcom also has high growth expectations baked into its market cap. Aramco is the spitting opposite; the Saudis don’t have to do more than pump oil at the same rate, so they got it all in the bag. The rest are more middle-of-the-roaders, but we must acknowledge that growth expectations above 20% are quite demanding.

Domodoran introduces the three Ps as a framework to interpret these results: possibility, pausability, and probability. Let’s take an example. Here’s how we can discuss Tesla in this framework.

Is it possible that Tesla doubles its sales in a year or two? No, the robotaxi launch has been uninspiring, and the humanoid robots are far from reaching industrial scale production. They exist only as prototypes. Can Tesla grow into its market capitalization if we give it more time? Yes, there is a chance; time has a cost, however, the longer the wait, the higher the breakeven revenues go, making the growth rate assumption even more demanding.

Does Tesla have a pathway to success? Yes, there is a path, but it is narrow. Its robots can suddenly be the next thing, the big seller, and the company could enjoy a time-limited monopoly on these products. This is more of a moonshot than a 100% certainty. Nevertheless, it is not totally implausible. The probability of success at this scale, however, is quite low despite a huge total addressable market. Although I’m not an expert concerning humanoid robot development, I do know the Chinese are not far behind, if they are behind at all, and when it comes to full self-driving, it could be argued that Google is a few steps ahead.

Naturally, you could disagree with me on all these counts. The point here is only to demonstrate how you could think about the three Ps.

Method

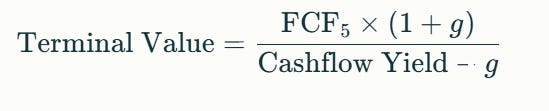

This is the formula Domodoran uses to find the breakeven revenue.

Most of the math is self-explanatory; g is the only elusive symbol, but it stands for the real inflation rate in this instance. This formula captures the revenue level a company must reach to justify its market cap, highlighting how profitability, growth, and risk assumptions impact valuation and investor expectations.

This formula denotes breakeven revenues after a 5-year waiting period.

FCF is a projection of what free cash flow is 5 years ahead, and g is, in this case, the overall real growth rate of the economy. Thus, the breakeven revenue is the level at which the present value of the projected cash flows equals the market cap. The terminal value should reflect where the company is supposed to be, given that it can grow its cash flow at the same rate as the overall economy, a steady state.

Applied maths

Damodaran’s framework provides a straightforward approach for conducting a comparative valuation. Let’s apply it to analyze and compare SalMar and Mowi, two leading Norwegian farming companies.

Salmar’s breakeven revenue

Market capitalization: 82.19 billion NOK

Revenue: 27.675 (2025E)

Cost of equity: 9%

Inflation rate: 2,5%

net margin: 14,1%

5-year average ROE:18%

= 43,1 billion NOK

Conclusion: Assuming that Salmar can maintain its 5-year historical CAGR of 9,2%. It will take roughly 5 years to grow into its valuation. However, during the 5-year waiting period, breakeven revenue will rise somewhat. Anyway, Salmar has many years of growth ahead before it reaches steady state, so it has a long time to grow into its market cap. It is possible, plausible, and probable that Salmar achieves this feat. Salmar is not, however, so undervalued as I deemed it just recently; the share price has risen approximately 20% this autumn. Thus, growth expectations have climbed substantially.

MOWI’s breakeven revenue:

Market capitalization: 122.6 billion NOK,

Revenue: 69.650 (2025E)

Cost of equity: 9%

Inflation rate: 2,5%

net margin: 9,8%

5-year average ROE:13,3%

= 97,4 billion NOK

Conclusion: Assuming that Mowi can maintain its 5-year historical CAGR of 6,5%. It will take over 5 years to grow into its valuation. This is slightly longer than Salmar, for what it’s worth. Breakeven revenue will also rise faster than Salmars over these 5 years due to lower margins and return on capital.

For this purpose, I didn’t do the final steps of the analysis. Salmar and Mowi are priced fairly the same. In general, it is often wisest to go with the company with the highest profitability. If you want to use Domodoran’s formula, play around with it, or do whatever, you can access his spreadsheet on his website. It is free to use.

Disclaimer: Important Information for Retail Investors

The information in this blog is for educational purposes only, not financial advice. Investing in stocks carries risks; past performance doesn’t guarantee future results. Conduct thorough research and seek advice from financial professionals before investing.

The author is a retail investor, not a licensed advisor. Due to changing market conditions, content accuracy isn’t guaranteed. All investments have risks, including the potential loss of principal. Assess your risk tolerance and goals before investing; diversification is key to managing risk.

The author may have positions in the mentioned stocks, which can change without notice. Readers should do their due diligence and consult professionals before acting on blog information.

Before investing, verify information from credible sources, understand prospectuses and financial statements, be aware of your financial situation, and consult professionals for aligned investment choices.

Readers are responsible for their investment decisions; the author is not liable for any outcomes. Investing in individual stocks carries risks; therefore, exercising caution, conducting thorough research, and seeking professional guidance are recommended for informed investment decisions.