Can They Work Again?

Novo Nordisk & Salesforce

Yes, Novo Nordisk (NOVO) and Salesforce (CRM) are parts of my portfolio. That’s no fun, is it? NOVO is down nearly 50% this year. CRM is down 31%. What’s even more fun is that I decided to add to both of them around late spring or early summer; I can’t remember the exact dates. So, what should I do with them?

Those old Texas sayings

There’s an old saying down in Texas: “Fool me once, shame on you; fool me twice, shame on me.”

Every earnings report this year, NOVO has gapped brutally down. On the second occasion, I’ve decided to add. Of course, there is a lesson in that: you should never buy profit warnings. When bad stuff happens, there is usually more to come. Well, at least I didn’t add on the third occasion.

I made the same foolish mistake with CRM. The only difference was that there was no profit warning, just a whole lot of negative market tape about AI replacing SaaS as a business model. We should always listen to the market. Of course, the market can be wrong, but in the short term, it doesn’t matter. Obviously, it was wrong to add to the position after the massive gap down. Dead money as long as the eye can see. To my benefit, I haven’t doubled down on the losing trade. CRM has stayed down after the gigantic springtime tumble, and the negative tape is intact. No changes there.

“Fool me once, shame on… shame on you. Fool me… You can’t get fooled again.” Don’t get shamed, folks. George Bush got it right.

The question remains, what should I do with these two positions now?

Has NOVO kitchen-sinked it?

I can’t be attacked for my lack of patience as an investor. When it comes to NOVO, it helps that I am up 70% over 5 years in the name overall, which isn’t spectacular, but not a catastrophe either.

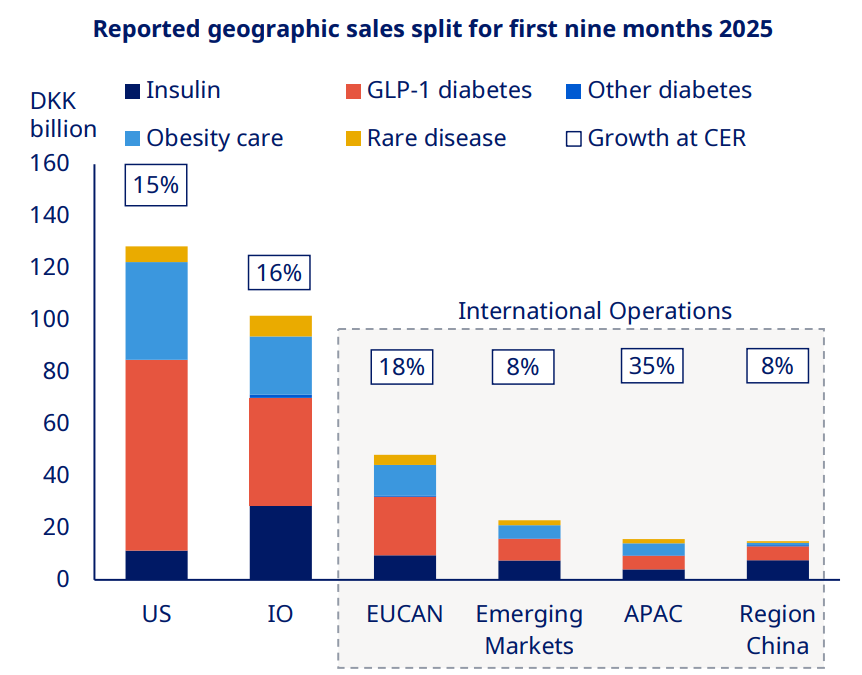

I still see a lot of potential in the company. The market for semaglutide and related GLP‑1 drugs for obesity and type 2 diabetes is already tens of billions of dollars annually and is projected to reach well over 100 billion dollars globally within the next decade. The U.S. market has started to mature, but in the rest of the world, only a fraction of the market has been captured. NOVO is now growing just as strongly outside of the U.S as within, see figure below.

NOVO’s annus horribilis ended with US price negotiations and a confirmation ceremony in the Oval Office. As a perfect picture, one of NOVO’s representatives fainted at the ceremony. In the carfufle, RFK Jr stormed out to get medical help, forgetting that Dr. Oz, standing next to him, is an actual medical professional, not a conspiracy theorist like himself. And he took care of business while he was running around screaming in the halls of the White House. Right there in the midst of it all was Donald Trump, looking bewildered, standing hunched over the whole scene while Dr. Oz raised the patient’s feet. You can’t make this stuff up.

Anyway, lower prices can be a blessing in disguise. By lowering prices, Novo gains much broader access to government-insured patients, including millions of Medicare and Medicaid beneficiaries who previously couldn’t afford these drugs. This can dramatically increase patient volume, offsetting lower per-unit prices and potentially leading to higher overall sales over time. Looking ahead, tougher competition and lower pricing can only be counteracted by higher volumes and efficient production. Now, NOVO knows the rules of the road, and NOVO is already on track to build out the capacity.

Recently, NOVO took another hit on the failed Alzheimer’s study. However, the share price bounced right back. After all, Alzheimer’s was nothing more than a vague comorbidity. This can be a signal that the last seller in the stock now has been washed out. So, NOVO can start to consolidate at these levels.

Only the future can tell if NOVO’s share price will climb upwards again. To add more to the stock, we need to see if a potential consolidation can take hold and whether a positive tape can start to build in the market. There are always second chances, and hope springs eternal. Nevertheless, the situation must be monitored. I am sticking to my holding for now.

Is CRM in a sinkhole?

So, what is the problem with CRM? Nothing if you listen to Wall Street analysts. They see the stock as undervalued, with an average price target of around $320. The company continues to report solid financials and is expected to grow earnings in the double digits next year. However, the market disagrees with the analysts, reflecting growing skepticism about CRM’s ability to maintain growth amid AI disruption and increased competition from both established tech giants and new AI-native platforms.

The refrain is that AI-first platforms are the new winners. Palantir is an example of one of these platforms with winds behind its sails. Lesser-known companies are HubSpot, Zendesk, Attio, and a few more. These AI-first platforms are not just offering incremental improvements; they are fundamentally changing the economics of SaaS. By compressing development cycles, enabling rapid feature expansion, and targeting niche markets, they threaten the dominance of legacy players in the SaaS space.

CRM is not rolling over in the face of this backdrop and tries to go on the offensive. The company has one trump card, an enormous installed base, and CRM is betting big on AI-driven solutions like Agentforce and Data Cloud to help it retain customers, drive future upselling, and cross-selling opportunities. In addition, the company is focused on gaining more SMB clients while maintaining disciplined cost control to enhance profitability. On the latest capital markets day, CRM expressed confidence in the sustainability of its double-digit revenue growth, projecting nearly 50% higher revenue from today’s level by the end of the decade. The company’s robust ecosystem, market leadership, and continued innovation in AI and data integration position it well for long-term growth

Still, risks remain: competition is fierce, integration of recent acquisitions (such as Informatica) is challenging, and core CRM segments are showing signs of saturation. Salesforce’s ability to maintain its market leadership will depend on how effectively it executes its AI strategy, adapts to evolving customer needs, and withstands challenges from AI-first platforms.

CRM’s future is in the balance. To say that CRM is in a sinkhole would be an exaggeration, but it could go either way. CRM is in a sink-or-swim moment. I am still massively up in the stock, so I have decided to stick around for the moment. Q3 earnings are coming up next week. Then we get a new chance to take a new look at the situation.

Falling knives

Yes, knives are falling. Let’s see whether I get chopped up further. Investing wouldn’t be any fun if it were only easy.

Disclaimer: Important Information for Retail Investors

The information in this blog is for educational purposes only, not financial advice. Investing in stocks carries risks; past performance doesn’t guarantee future results. Conduct thorough research and seek advice from financial professionals before investing.

The author is a retail investor, not a licensed advisor. Due to changing market conditions, content accuracy isn’t guaranteed. All investments have risks, including the potential loss of principal. Assess your risk tolerance and goals before investing; diversification is key to managing risk.

The author may have positions in the mentioned stocks, which can change without notice. Readers should do their due diligence and consult professionals before acting on blog information.

Before investing, verify information from credible sources, understand prospectuses and financial statements, be aware of your financial situation, and consult professionals for aligned investment choices.

Readers are responsible for their investment decisions; the author is not liable for any outcomes. Investing in individual stocks carries risks; therefore, exercising caution, conducting thorough research, and seeking professional guidance are recommended for informed investment decisions.