Amgen

When biotech goes amok!

Amgen is something unusual as a mature biotech company. Tellingly it is the only biotech company that has made it onto the Dow index. Amgen is most known for its old flagship drug EPO, developed for kidney patients, but also used by endurance athletes for more nefarious reasons. EPO went off-patent long ago and doesn’t contribute much to revenue anymore. However, Amgen has never stopped innovating, and now the company is set to take the business to a whole new level.

I initiated a position last week This is why.

Broad drug portfolio

Amgen has a diversified drug portfolio. The portfolio spans general medicine, inflammation, oncology, and rare diseases. Revenues are relatively evenly spread between the various segments. Amgen has no apparent blockbusters that the company is overly dependent on, but let’s be clear, some of the drugs are hugely successful, Prolia, for instance, stands out as a go-to-drug for everyone with Osteoporosis.

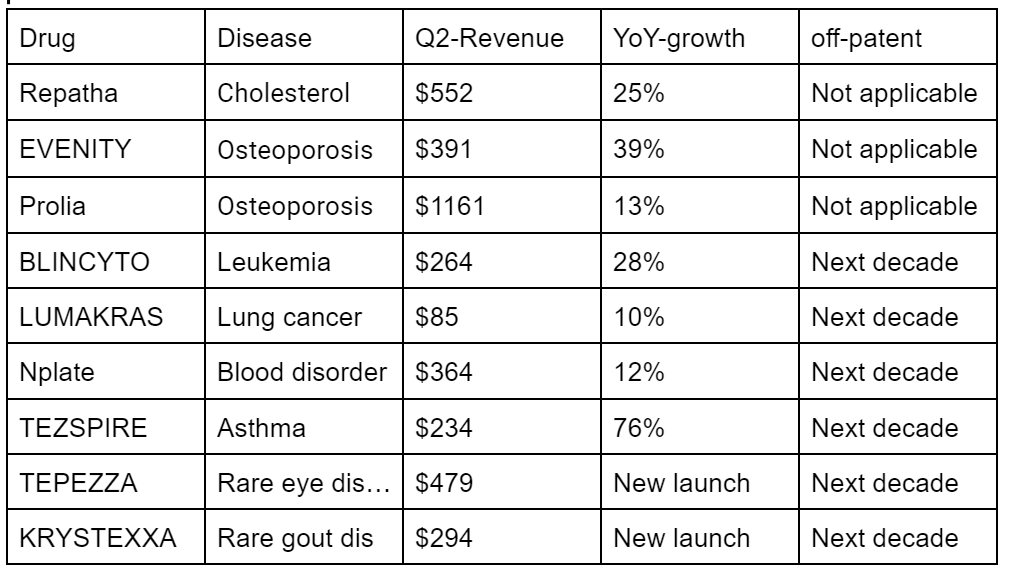

The company has 12 drugs in its portfolio growing by double digits. I have listed 10 of them in the table below. Many growers are legacy products derived from recently acquired Horizon Therapeutics, which has bolstered Amgen’s flywheel into oncology and rare diseases.

Strong and diverse pipeline

Amgen has a lot going on in its pipeline. I will not go through all of it here. It is simply too much. However, I will say a few words about the trials which are in their final stages.

The oncology division sees a lot of action. The most important near-term question is whether BLINCYTO has efficacy in pancreatic and colorectal cancer in addition to Leukemia. Another important drug is IMDELLTRA. The drug has already been approved for treating patients with late-stage lung cancer. IMDELLTRA is expected to gain acceptance in earlier stages of the disease later this year. In addition, Amgen has achieved breakthroughs in prostate cancer but this drug has not reached phase II yet. However, the drug Nplate is as good as finished with all its trials, and we are expecting full results shortly.

Over to rare diseases. UPLIZNA has reached phase III. The same goes for Dazodalibep. UPLIZNA is meant to treat a rare blood disorder, while Dazodalibep is designed to treat Sjøgren’s disease.

Amgen’s most interesting research happens in general medicine. Late-stage trials are ongoing in programs covering asthma, liver disease, and obesity. Among these programs, MariTide is the most exciting since it deals with obesity. It is MariTide that makes Amgen a buy for prospective investors. I will explain this more in depth below.

Valuation

Due to the Horizon acquisition, Amgen will grow its revenue by nearly 20% this year. However, Wall Street analysts think growth will stall from next year as the effects of the Horizon integration ebbs out. Looking at the pipeline, and how strongly many of the drugs grow, this seems too pessimistic to me. Based on Amgen’s trajectory, I think Amgen will continue to grow by at least 4% in 2025 and 2026. Furthermore, Amgen has MariTide as a joker in its deck, which can be played out if the trials go well, enabling it to tap into the lucrative obesity market. Valuation will never be more than an estimate of a company’s intrinsic value, but based on my overall view, I see Amgen as undervalued here. From a risk/reward perspective, picking up Amgen below $350 is a good price.

Obesity

Amgen has a legacy business in diabetes. To transition from insulin to GLP-1 semiglutide isn’t much of a stretch.

Amgen’s obesity drug MariTide is a once-a-month injectable. Results from the phase II trial will be reported in December this year. Apparently, the preliminary results must have been fairly successful because Amgen has already started recruiting patients for its phase III trials.

The obesity market is projected to have a dollar tag of $100B. So, here there is enough business to go around for many. Seeing how much Novo Nordisk and Eli Lilly sell off the GLP-1 hormone, it is not an exaggeration to posit that Amgen’s top line can expand between $5B - $10B solely on the back of MariTide if it can make somewhat of a competitive product. Considering that Amgen has guided sales for around $33B in 2024, it is easy to see that MariTide can be a game changer.

In 2030, the obesity market is likely to divert into several strains. We can broadly segment the market into two patient groups: overweight and obese patients. Pills will come into the market. Oral’s is likely to be enough for the overweight and the vain. Obese patients, however, will continue to need injectables with higher dosages. Efficacious therapies with fewer injectables are likely to be favored among patients over therapies with many, but patients will get many choices.

Final consideration

Amgen piled on debt to purchase Horizon. Today, Amgen has $62B in debt outstanding. Amgen plans to reduce debt by $10B in the next year and a half, ensuring less burdensome interest payments.

Due to the deleveraging process, investors can’t expect a lot of buybacks. However, Amgen pays a healthy dividend that likely will increase by up to 10% yearly.

Disclaimer: Important Information for Retail Investors

The information in this blog is for educational purposes only, not financial advice. Investing in stocks carries risks; past performance doesn't guarantee future results. Conduct thorough research and seek advice from financial professionals before investing.

The author is a retail investor, not a licensed advisor. Content accuracy isn't guaranteed due to changing market conditions. All investments have risks, including the potential loss of principal. Assess risk tolerance and goals before investing; diversification is key to managing risk.

The author may have positions in the mentioned stocks, which can change without notice. Readers should do their due diligence and consult professionals before acting on blog information.

Verify information from credible sources; understand prospectuses and financial statements before investing. Be aware of your financial situation and consult professionals for aligned investment choices.

Readers are responsible for their investment decisions; the author is not liable for any outcomes. Investing in individual stocks carries risks; caution, research, and professional guidance are advised for informed decisions.